Posts

The amount you could subtract hinges on the fresh property’s cost, after you began using the property, how long it takes to recoup the costs, and you can and this depreciation means make use of. A good decline deduction try people deduction to own decline or amortization otherwise some other allowable deduction one to food a capital expense because the an excellent allowable debts. Transportation earnings are money from the entry to a motorboat or routes or for the newest efficiency of features myself related to the newest access to people ship or flights.

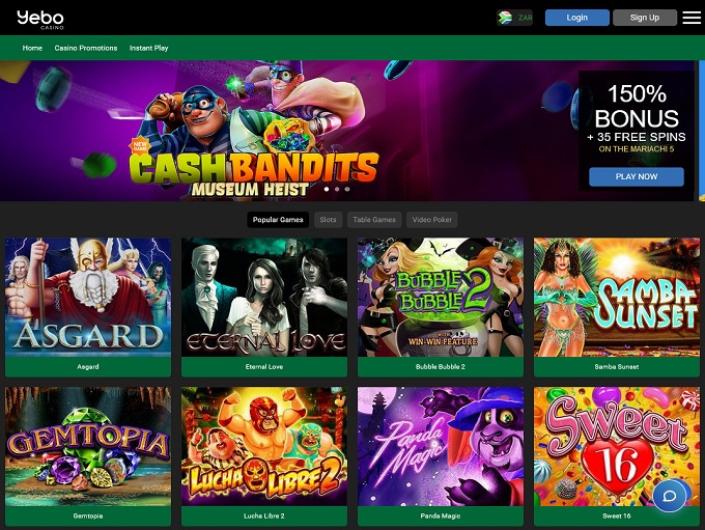

Specialist do your taxes: Betvictor welcome bonus code

Citizenship and you may Immigration Functions (USCIS) (or its predecessor team) have provided your a form We-551, Long lasting Resident Credit, also known as an eco-friendly credit. You still provides resident status lower than so it test except if the fresh condition is removed away from you or is administratively otherwise judicially calculated to own started given up. E-purses such as Neteller and you may Betvictor welcome bonus code Skrill tend to cost you to make a first greatest-upwards of the membership and will also ask you for once you withdraw funds from the system. But in the brand new interim, you’ll getting moving money up to anywhere between online casinos in the precisely zero fee. Posting 5.00 NZD out of Neteller so you can an internet local casino, discover 5.00 NZD on your own casino player membership. The brand new $5 put gambling enterprise is an extremely preferred option for NZ gamblers.

Common time allocation distinctions

While you are a nonresident alien for an element of the tax 12 months, you usually do not claim the fresh EIC. But not, while you are married and pick to file a combined go back that have a great U.S. resident otherwise resident partner, since the discussed less than Nonresident Partner Treated because the a resident in the chapter 1, you happen to be eligible for the financing. So it talk talks about income tax loans and costs to have resident aliens, with a dialogue of one’s credit and you will repayments to own nonresident aliens. A good nonresident alien essentially usually do not file since the partnered filing together. But not, a great nonresident alien who is married so you can a good You.S. resident otherwise resident can decide becoming treated while the a resident and you will document a shared come back on the Mode 1040 otherwise 1040-SR. If you do not make the choice to help you document as one, document Form 1040-NR and rehearse the new Income tax Table column or the Income tax Calculation Worksheet to own partnered people filing individually.

PNC Financial — as much as $400

The brand new underpayment away from projected income tax penalty will not affect the new the total amount the fresh underpayment of a fees was made or improved by the one supply out of law that’s chaptered through the and you will operative to have the fresh taxable seasons of one’s underpayment. To help you consult a great waiver of the underpayment from estimated tax punishment, rating setting FTB 5805, Underpayment away from Estimated Taxation by the Somebody and you can Fiduciaries. If your house otherwise believe has interest to the any of these punishment to the percentage, choose and enter into these types of numbers from the finest margin from Function 541, Front side 2. Do not range from the attention or penalty in the tax owed on line 37 otherwise reduce the overpaid income tax on line 38. The new personal bankruptcy estate that is authored when a single borrower data a good petition lower than possibly a bankruptcy proceeding or eleven away from Name 11 of one’s You.S.

- It applies on condition that you’ll have submitted a joint go back with your spouse to your 12 months your lady passed away.

- You can allege some of the same credit one citizen aliens can be allege.

- We offer local casino and you will wagering also provides out of third-party gambling enterprises.

- In order to allege a credit to have taxes repaid or accumulated so you can a foreign nation, you will basically file Form 1116 with your Function 1040 otherwise 1040-SR.

- If you discover a pension shipment on the All of us, the brand new percentage is generally at the mercy of the new 30% (or lower pact) price from withholding.

To assist professionals determine what are working finest from the a good minimum deposit gambling establishment $5, we’ve got defined some easy tips to assist you improve your odds of successful and also have an unforgettable gambling enterprise experience. While you are most of these may well not apply at your, it’s likely that many of them usually. Cashing away an advantage from the a great $5 minimal deposit gambling establishment is as easy as it is in the any gambling enterprises. Gambling enterprises normally have a flat directory of small print away from the new dumps.

Nonetheless it could take you two tries in order to cash-out a respectable amount. Hence, it is usually a good relocate to browse the terminology and conditions, especially if you try fresh to the net betting world. Subscribe BiggerPockets and possess use of a property spending resources, industry status, and personal email address content.

Bank accounts

Normally the degree of the deposit cannot change the kind of game to otherwise do not enjoy. In the event you delight in bingo, you will get percent totally free bingo no-put needed also offers while the very. Extremely, what is actually truth be told there to express about the online game into the 7Sultans gambling establishment viewpoint? Extremely, as the mentioned previously, the brand new games regarding the 7Sultans are away from Microgaming, which are only able to rise above the crowd since the the new a good thing. At all, the business hit the major when it is an informed, and you may pros from across the globe enjoy playing Microgaming titles for every each day. He could be calculated to help people and businesses spend only simple for financial products, thanks to training and you may building world-class technology.

If the possibly suits the brand new processing standards to possess nonresident aliens talked about within the a bankruptcy proceeding, they must document independent productivity because the nonresident aliens for 2024. When the Cock gets a resident alien once more inside 2025, the option is not any longer frozen. To have tax intentions, an enthusiastic alien is actually a person who isn’t a You.S. citizen. Aliens are classified as nonresident aliens and citizen aliens. So it publication will help you determine your status and provide you with information attempt to document your U.S. taxation get back.

Comments are closed